37+ is mortgage insurance tax deductable

This income limit applies to single head of household or married. Contact the mortgage insurance issuer to determine the deductible amount if it is not.

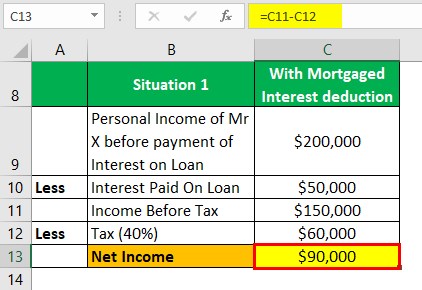

Mortgage Interest Deduction How It Calculate Tax Savings

Types of mortgage insurance generally considered tax.

. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Home equity loans and cash-out. Ask a Verified CPA How to Benefit from Tax Deductibles.

The itemized deduction for mortgage insurance premiums has been extended through 2021. Also your adjusted gross income cannot go over 109000. Web In general most closing costs are not tax deductible.

Web When the deduction for PMI costs were last regularly available for MI premiums paid though 2021 there were limitations. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. The source of the down payment can be savings a verified gift from a relative or a.

The PMI policys mortgage had to. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad Ask a Tax Expert About Tax Deductible Limits.

We dig into the details about current mortgage. Learn more on the IRS site. However higher limitations 1 million 500000 if married.

Web Up to 96 cash back 100000 50000 if married filing separately Eliminated if your AGI is more than one of these. For married couples filing separately if each partner. Connect Online for Tax Guidance.

475 7 votes Mortgage insurance premiums. Web fees can be deducted fully in 2020 if the mortgage insurance contract was issued in 2020. ITA Home This interview will help you.

Homeowners can deduct the interest paid on the first. Web The mortgage insurance premium deduction is not permanent in the tax code but it has been extended every year since 2006. Web Depending on your income and loan type you may be able to deduct your mortgage insurance on your federal taxes.

Connect Online Anytime for Instant Info. Web The itemized deduction for mortgage insurance premiums has expired and you can no longer claim the deduction for tax year 2022. Web Private mortgage insurance is generally referred to as MIP mortgage insurance premiums.

Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. For example if you. Once your income rises to this level.

Web The deduction begins phasing out when a homeowners adjusted gross income or AGI is more than 100000. Web If your adjusted gross income for the year is 109000 or more youre not qualified for a PMI deduction. Web Is mortgage insurance tax-deductible.

109000 54500 if married filing separately The mortgage insurance. Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses. Web This deduction allows you to claim the total amount paid toward your mortgage interest within one year.

Web Read about the Mortgage Insurance Tax Deduction Act of 2017. Web Mortgage tax deductions and other homeowner costs were affected by the federal governments 2018 tax overhaul. Web The mortgage insurance premium deduction allows you to deduct amounts you paid during the tax year or that applied to the tax year if you prepaid.

But if not you can deduct them pro rata over the repayment period. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web These costs are usually deductible in the year that you purchase the home.

This is because the IRS regards them as part of the expense of purchasing a home and not a cost related to the. Homeowners who bought houses before. It can increase your monthly payments and your closing costs as.

Web Borrower has a down payment of at least 35 of the purchase price.

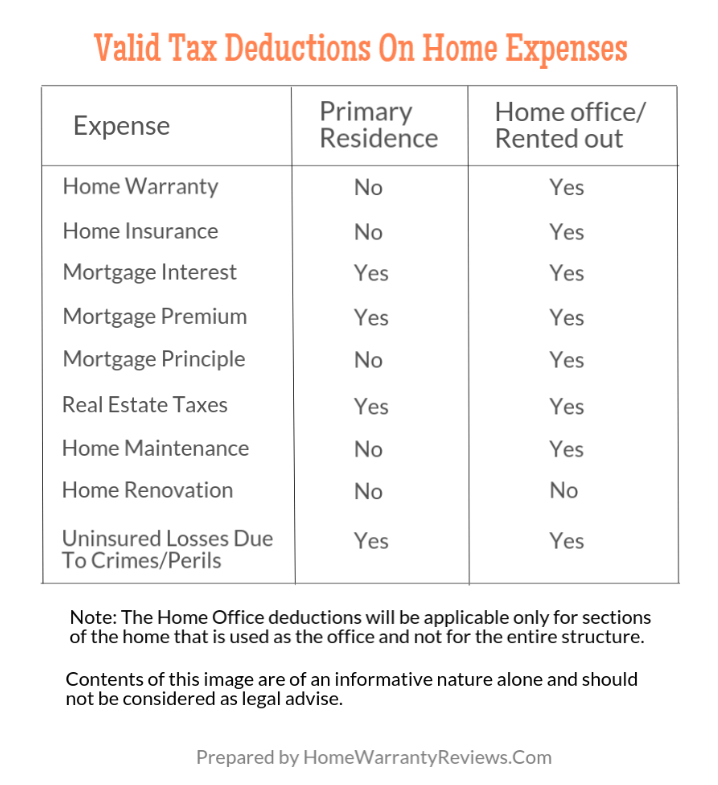

Are Home Warranty Premiums Tax Deductible

Business Succession Planning And Exit Strategies For The Closely Held

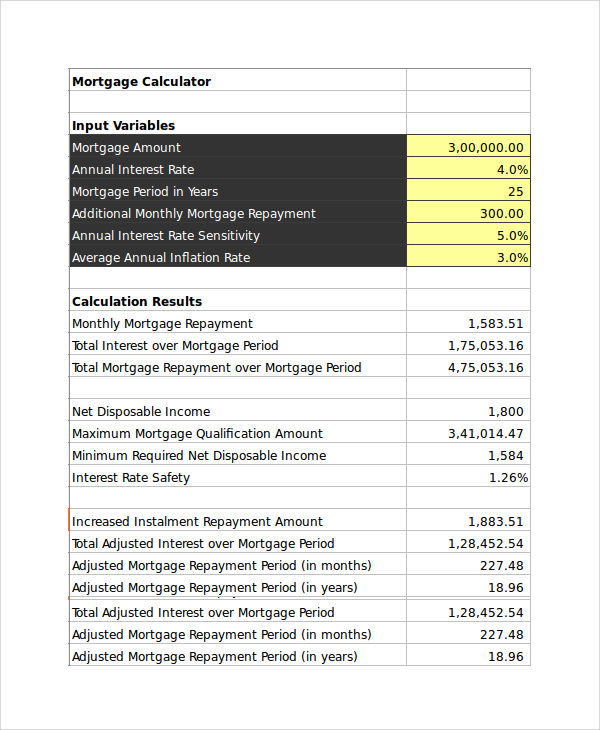

Free 6 Payment Calculator Mortgage Samples In Pdf Excel

Is Private Mortgage Insurance Pmi Tax Deductible

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Free 37 Proposal Forms In Pdf Excel Ms Word

American Economic Association

Do You Remember The Last Time You Were Completely Debt Free

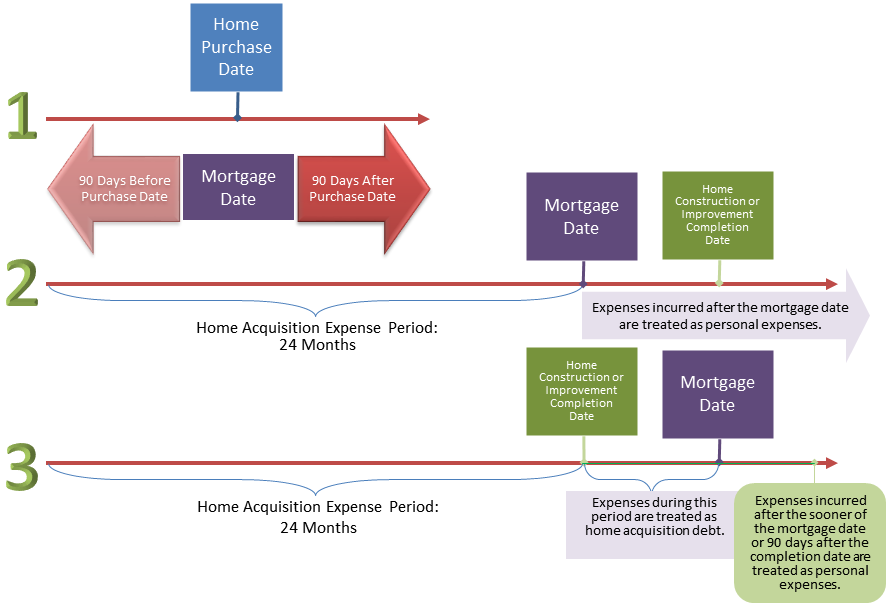

Itemized Deductions For Interest Expenses On Home Mortgages And Home Equity Loans

Vystar Credit Union Review High Interest Rates On Cds

Valuation Of Mortgage Interest Deductibility Under Uncertainty An Option Pricing Approach Sciencedirect

Free 37 Sample Claim Forms In Pdf Excel Ms Word

8rxmgyydzilfcm

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Can You Deduct Mortgage Pmi On Your Tax Return Pinewood Consulting Llc

Where Oh Where To Deduct Mortgage Interest U Of I Tax School

:max_bytes(150000):strip_icc()/84422303-56a938cc5f9b58b7d0f95ec6.jpg)

Learn About Mortgage Insurance Premium Tax Deduction