36+ claiming mortgage interest on taxes

Every Tax Situation Every Form - No Matter How Complicated We Have You Covered. Single taxpayers and married taxpayers who file separate returns.

Mortgage Interest Deduction Bankrate

Web Up to 96 cash back Answer.

. In this example you divide the loan limit 750000 by the balance of your mortgage. Homeowners who bought houses before. Web Up to 96 cash back Used to buy build or improve your main or second home and.

Web If you claim the standard deduction you will not include any mortgage interest or real estate taxes on lines 10 and 11. 12950 for tax year 2022. Discover Helpful Information And Resources On Taxes From AARP.

Secured by that home. Web Standard deduction rates are as follows. Get Started On Your Return Today.

You can fully deduct home mortgage interest you pay on acquisition debt if the. Web If they paid 15000 in mortgage interest donated 3000 to charity and paid 3000 in state and local taxes itemizing would have given them an extra 11300. File Your Own Taxes at Any Time From Anywhere with HR Block Online.

Ad File 1040ez Free today for a faster refund. Web Basic income information including amounts of your income. Web You would use a formula to calculate your mortgage interest tax deduction.

Web The table above shows that if youre single taxpayer youd need at least 340000 in mortgage debt to claim the mortgage interest deduction. Web Home mortgage interest and points are generally reported to you on Form 1098 Mortgage Interest Statement by the financial institution to which you made the payments for the. Publication 936 explains the general rules for.

Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

Instead you will claim the entire business use of the. Web Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms. To deduct taxes or interest on Schedule A Form 1040 Itemized Deductions you generally must be legally obligated to pay the expense and must have.

Web Occupying and maintaining the home and paying the mortgage and taxes on it are strong factors that probably would indicate equitable ownership. Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible. Ad Did Your Know You Can File Taxes Online with HR Block.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. But even if your.

Ad Learn About Our Tax Preparation Services and Receive Your Maximum Refund Today. A general rule of thumb is the person paying the expense gets to. Web Yes and maybe.

There is no specific mortgage interest deduction unmarried couples can take.

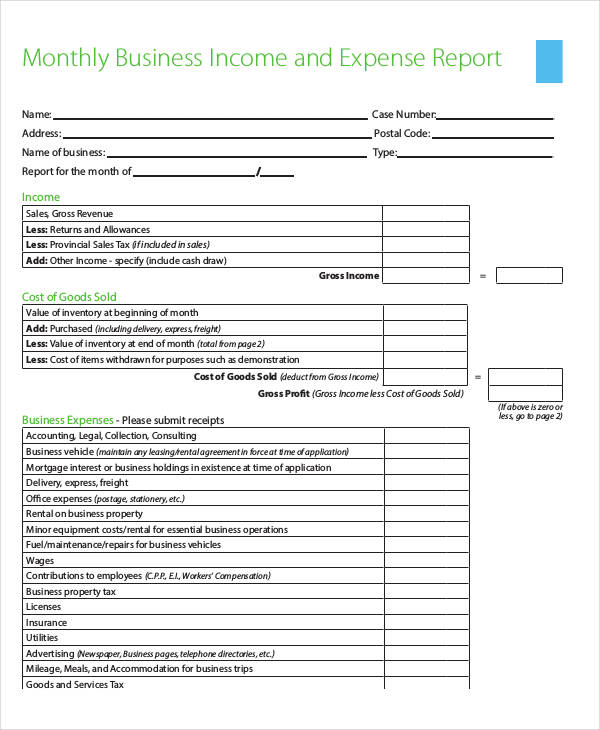

Expense Report 36 Examples Samples Pdf Google Docs Pages Doc Examples

Mortgage Interest Deduction Bankrate

.png)

Should I Wait Until The Market Crashes Until I Buy Another Investment Property Northwest Atlanta Properties

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Tackling The Big Debt That Lawmakers Let Balloon Calpensions

Oregon S Mortgage Interest Deduction Reportedly Inequitable

Mortgage Interest Deduction Rules Limits For 2023

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

16211 Moccasin Ranch Road La Grange Ca 95329 Compass

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Maximum Mortgage Tax Deduction Benefit Depends On Income

Race And Housing Series Mortgage Interest Deduction

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction A Guide Rocket Mortgage

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Braun No Touch Touch Thermometer With Age Precision Positioncheck Dual Technology Safe Hygienic Fast Clinically Accurate Easy To Use For All Ages Bnt400b Amazon De Health Personal Care

Haiboxing Remote Control Car 2 4ghz 1 18 Proportional 4wd 36 Km H Hobby Rc Car Offroad Monster Rc Truck Waterproof Rc Truggy Rtr Off Road Toy Amazon De Toys